How to Use the Week-by-Week ATM Straddle Performance Report

The ATM Straddle Performance report is designed to help you find option symbols that

have had consistently undervalued (or overvalued) at-the-money straddles over an extended

period of time.

Ideally a trader would use the report to enhance their options trading research and

help generate ideas for positions to take on at-the-money option straddles.

The report is fully functional for both Premium Total Access and Options Trader subscribers.

How To Find It

From the main menu go to Options > Week-by-Week ATM Straddle Performance (or click this link).

Methodology

The report deals directly with at-the-money option straddles. If you are not familiar with straddles, you can learn about them here .

At a base level, the report tries to answer the question: If I bought a straddle at a certain point in time and held it until the end of the week (or until it expired),

would that straddle have gained value?

To do this, what we do is sort through millions of option market snapshots to find the value of option straddles at the beginning of a week

(typically Monday morning), and track the performance of that straddle until the end of the week (typically Friday market close).

We use each symbol's nearest expiration (sometimes called the "Front Month") -- so that if we are looking at straddles from the week of

Monday, February 1st through Friday, February 5th, we will use the nearest expiration on or after February 5th.

We find the value of the option straddle at the beginning of the week (the "Opening"), and treat this as if it would be the time

when the theoretical trade would be purchased. Then, the end of the week (the "Closing") is treated as if it is the time when

the theoretical trade is then sold back. If the straddle gains value from Opening to Closing, this is considered a "win" for the week.

You can use the report to find which symbols produce the highest "win" rates within an extended period of time.

We track these results over the most recent number of weeks indicated on the report. The base report shows the last 12 weeks, however, with the

filter, you can change it to view the last 6 weeks, last 3 weeks, last 2 weeks, or last 1 week only.

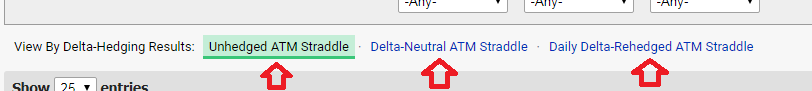

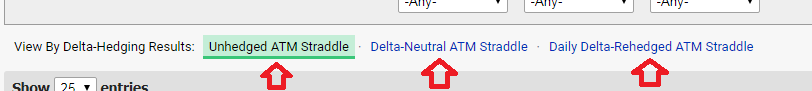

Delta-Hedging Techniques

An important concept that goes hand-in-hand with option trading is delta-hedging. To learn more about delta, visit this page.

To learn more extensively about delta-neutral trading, visit this page.

Within the ATM Straddles Performance report, MarketChameleon provides the ability to toggle between different delta-hedging concepts to see

how different techniques could affect results.

Unhedged ATM Straddle is a naked option straddle, 1 call and 1 put on the same at-the-money strike, with no additional stock traded.

The resultant value is based solely on the value of the options themselves. Any net delta made from the trade is left untouched.

Delta-Neutral ATM Straddle is based on hedging the straddle's initial net delta to neutral, and then leaving the trade untouched

for the remainder of the week.

Daily Delta-Rehedging is based on hedging the net delta both initially at the "opening" of the trade, and then daily at the end of each

day to neutralize the delta.

For techniques that include delta-hedging, the straddle return and the win rate would both be affected by the gain or loss in value of the

underlying stock that results from hedging.

Below is a screenshot of where you can toggle between these choices on the report.

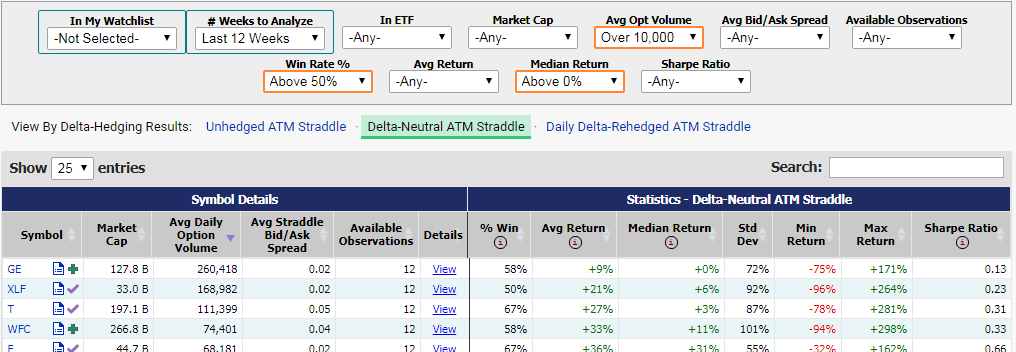

Using the Table

- Sort the table by clicking on column headings

- Search for specific stock symbol by using the "Search" field

- Click on Symbol Link or Fact Icon for more detail on a specific stock

- Click the "View" link to view the detailed breakdown, week-by-week, of the straddles for that particular symbol

- "View" symbol results appear at the bottom of the page

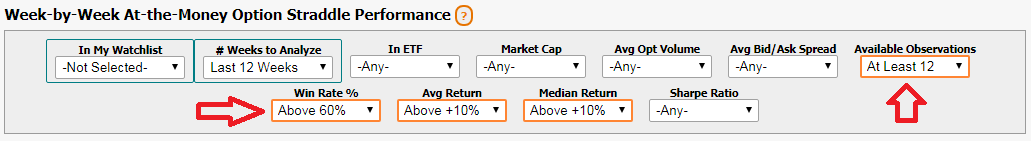

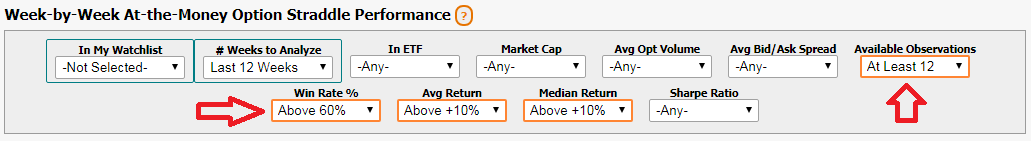

Below is a sample screenshot of the filters available for use on this report.

-

The In My Watchlist filter allows you to narrow the results

of the table to only those symbols listed within one of your customizable watchlists accessible

through your MarketChameleon account.

-

# of Weeks to Analyze can change the timeframe used within the report -- from a default of "Last 12 Weeks" to last 6 weeks, 3 weeks,

2 weeks, or 1 week only.

-

The In ETF filter allows you to narrow results based on those symbols which are currently listed as holdings of a number of

popular market-leading ETFs, like SPY, QQQ, and DIA.

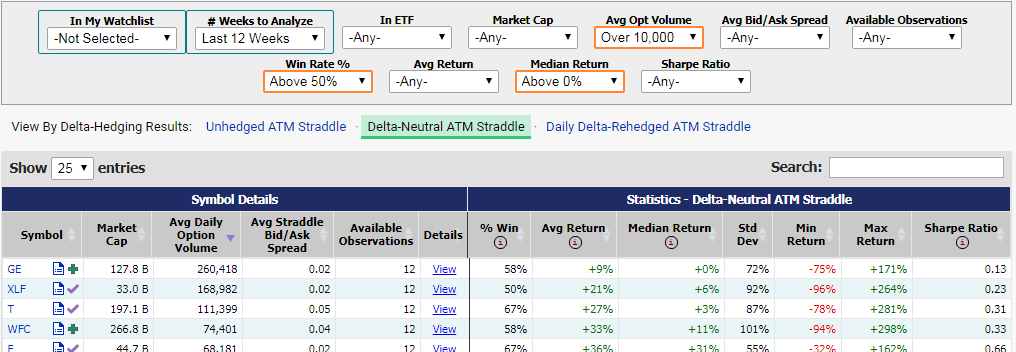

Explanation of Results

-

Avg. Straddle Bid/Ask Spread: for the number of weeks indicated, this is the average combined bid/ask spread

for the call and the put of the ATM straddle. For example, if the call is 10 cents wide and the put is 20 cents wide,

that combined spread would be 30 cents

-

Available Observations: the number of weeks within the designated period of time that we have data for that symbol.

Some symbols have newly listed options or halted their options trading for spans of time within the range of the report.

So if you selected "Last 12 Weeks", sometimes the symbols will only have 11 or 10 (or fewer) available observations

-

% Win Rate: the number of times (out of the available observations) that the theoretical straddle trade gained value.

When viewing delta-hedged results, the win rate would be impacted by the gain or loss in the trading of

underlying stock associated with the hedging

-

Avg. Return: each observation results in a net return on the straddle for that week. We calculate the return in percentage terms,

i.e. +10% or -25% for that week. Then, we take all of the returns over the observation set and get an average for the span

-

Median Return: the same as the average return, except it is the median value of all the observation returns.

Sometimes averages can be skewed significantly by one or two extreme results. Using both average and median return helps to narrow the result set

-

Std Dev: the standard deviation of that symbol's returns within the set of available observations.

The lower the standard deviation, the more consistent

the results are

-

Minimum Return: the lowest, or worst, return within the set of available observations.

It doesn't always have to be negative if all of the results were positive

-

Maximium Return: the highest, or best, return within the set of available observations.

It doesn't always have to be positive if all of the results were negative

-

Sharpe Ratio: a value which indicates the average return divided by the standard deviation. A high, positive Sharpe Ratio would

show that the average return is relatively high and the deviation in the results is relatively low -- suggesting a consistently

well-performing straddle

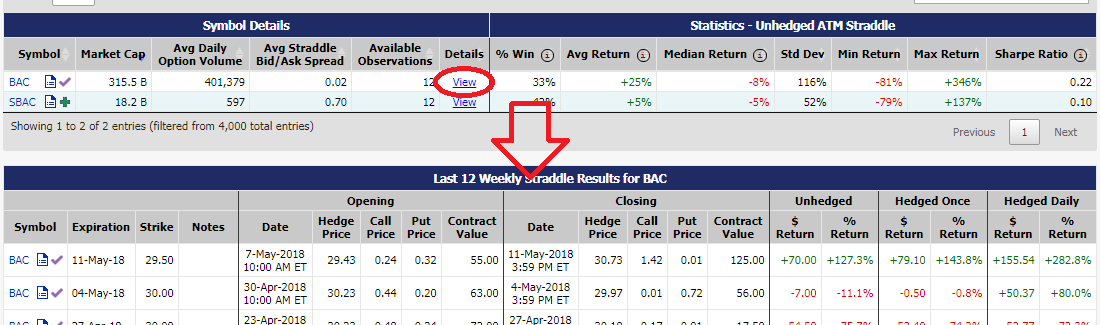

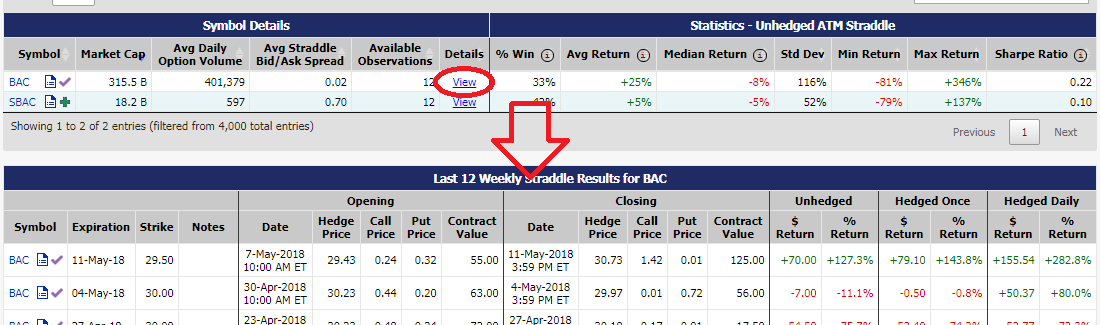

Single-Symbol Results

To view individual results by symbol, showing the week-to-week straddle performance, click on the link that says "View" on the

desired row of the table. At the bottom of the page you'll see the breakdown for up to the last 12 weeks.

This table shows you the Expiration and Strike for the specified straddle, and compares the "Opening" values

to the "Closing" values. You can see Notes, which would indicated whether there was an earnings date sometime within the week

specified. Towards the right of the table you'll see the different returns based on the available hedging techniques used.

$ Return shows the raw return in the strategy based on dollars (the theoretical trade assumes the purchase of 1 long call and 1 long put),

while the % Return shows that value in terms of percentage of initial straddle cost.