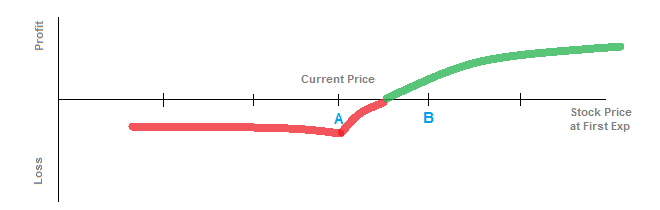

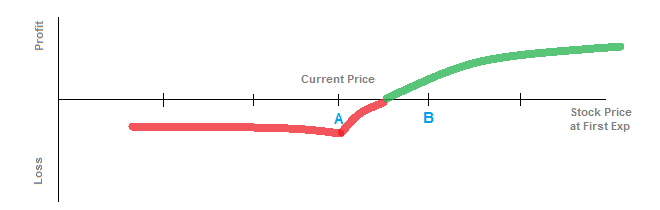

Sample Payout Diagram

Legs

- Buy Call, Strike A, for Near Expiration

- Sell Call, Strike B, for Far Expiration

Strategy Description

The Diagonal Call Spread is an advanced strategy that resembles the Calendar Call Spread

in a sense because you are buying a call in one expiration and selling in another. In this case, you'd be buying and selling on different strikes as well, thus "diagonal".

In the example we're using, you'd be buying an at-the-money call in the near-term expiration (strike A) and selling an out-of-the-money call for the far-term expiration (strike B).

Ideally, you would try to establish the strategy for a net credit, but it is dependent upon the strikes you use and the time value of the options.

An Example

Let's say you buy a call for at the $100 at-the-money strike for $2, and it has 30 days to go until expiration. Also, you sell a call for $3 on the $105 strike that has

60 days to go until expiration, so you bring in a net credit of $1. If the stock increases to $105 by the end of the first 30 days, the option that you purchased in the near-term

is now worth $5 (and you bought it for $2). The far-term option would be expected to lose some time value or experience a decrease in implied volatility that offsets the

gain in stock price. Let's assume the far-term option remains $3. Then the strategy that originally brought in a $1 credit can be closed out for a profit. You would

sell the near-term option for $5 (profiting $3 from the original $2) and you would buy back the far-term option for $3 (breaking even from the $3 you sold it for initially).

As a whole, you'd profit $3 on this example.

When to Use It

You would use this strategy if you feel the stock price has a good chance to drift higher during the first expiration and settle

near the higher strike (that you're selling, strike B). You would also be expecting the far-term expiration's implied volatility to

decrease as the stock drifts higher, so the gain in stock price is offset by a lower implied volatility and a lower time value in the

far-term option.

Break-Even Points at Expiration

The break-even is dependend upon several variables, because the far-term option is still active at the time of the near-term expiration. You can approximate

the break-even points based on time decay, implied volatility, and stock price movement, but choosing an exact break-even point is not an essential feature

of this strategy.

Max Gain

The potential maximum gain is achieved if the stock price at expiration is near the higher strike, and your long option in the near-term gains value

but the short option in the far-term loses time value and volatility.

Max Loss

The maximum loss is not easy to determine because the value of the short option in the far-term would be unknown when the near-term option expires.